Micro Fire Inconvenience Expense Insurance Expands to Tainan City, Over 30% of Low and Middle-Income Residents Nationwide Covered – Liberty Finance

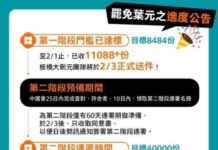

Tainan City collaborates with Nan Shan Life Insurance Charity Foundation and Nan Shan Property to provide property insurance micro policies for low and middle-income residents, enhancing protection for vulnerable groups. The Nan Shan Life Insurance Charity Foundation has donated premiums to offer “Nan Shan Property Micro Fire Inconvenience Expense Insurance” coverage to 35,000 qualifying low and middle-income residents in Tainan City. In the unfortunate event of a fire at the insured person’s residence, resulting in damage to the building itself or household items, each individual can receive a fixed amount of NT$8,000 in fire inconvenience expense insurance, with a one-time payment for each incident and a maximum of two payments during the insurance period.

Nan Shan Property highlights that the “Nan Shan Property Micro Fire Inconvenience Expense Insurance” was piloted by the Financial Supervisory Commission in August 2023, marking the first micro property insurance policy in Taiwan. Through the donation of premiums by the Nan Shan Life Insurance Charity Foundation, the initiative has expanded to collaborate with Pingtung County, Hsinchu County, Penghu County, Keelung City, Nantou County, Changhua County, and Tainan City, benefiting over 30% of low and middle-income residents nationwide by enhancing risk protection in property insurance.

Recognizing the significance of caring for vulnerable groups, Nan Shan Property Insurance has received numerous awards for the “Nan Shan Property Micro Fire Inconvenience Expense Insurance.” Given that fires often lead to the loss of property, there is a pressing need for emergency relief funds to address immediate needs such as basic food and temporary accommodation. During the claims process, assistance will be provided to policyholders affected by disasters to promptly receive the inconvenience expense insurance payout, aligning with the insurance industry’s mission of providing emergency assistance.

In a recent example, Changhua County joined the collaboration in June of this year. Following a fire in a townhouse, it was reported that 32 units were affected, potentially impacting vulnerable residents. Nan Shan Property Insurance promptly contacted the Changhua County government, established a claims team, and initiated rapid claims processing services. With the assistance of the social welfare department, the affected residents were quickly identified, and funds were disbursed through bank transfers or on-site distribution as needed, along with offering condolences and necessary assistance.

Expanding Coverage and Impact

The expansion of the “Nan Shan Property Micro Fire Inconvenience Expense Insurance” to Tainan City signifies a significant step towards enhancing the financial security of low and middle-income residents. By partnering with local governments and charitable foundations, Nan Shan Property Insurance aims to provide comprehensive coverage that addresses the specific needs of vulnerable populations in the event of a fire. This initiative not only safeguards individuals’ property but also alleviates the financial burden that may arise from such unforeseen circumstances.

Moreover, the collaboration between Nan Shan Property Insurance and various counties and cities across Taiwan demonstrates a concerted effort to extend the reach of micro insurance policies to those who may not have access to traditional insurance products. By prioritizing the needs of low-income and vulnerable communities, this initiative contributes to building a more inclusive and resilient society where individuals can have peace of mind knowing they are protected against unforeseen events like fires.

Community Support and Relief Efforts

The proactive response of Nan Shan Property Insurance in providing swift assistance to residents affected by fires underscores the company’s commitment to supporting communities in times of crisis. By establishing dedicated claims teams and working closely with local authorities, Nan Shan Property Insurance ensures that affected individuals receive timely support and financial assistance to address their immediate needs.

Furthermore, the collaboration with government agencies and social welfare departments highlights the importance of coordinated efforts in disaster response and relief operations. By leveraging existing networks and resources, Nan Shan Property Insurance can effectively streamline the claims process and expedite the disbursement of funds to those in need. This not only facilitates the recovery process for affected individuals but also fosters a sense of solidarity and support within the community.

Sustainable Impact and Future Prospects

As the “Nan Shan Property Micro Fire Inconvenience Expense Insurance” continues to expand its coverage to more regions in Taiwan, the long-term impact of this initiative on low and middle-income residents is expected to be substantial. By providing affordable and accessible insurance options tailored to the specific needs of vulnerable populations, Nan Shan Property Insurance contributes to enhancing financial resilience and security for underserved communities.

Looking ahead, the success of the micro insurance program in Tainan City and other regions sets a positive precedent for future collaborations between insurance providers, government agencies, and charitable foundations. By working together to address the insurance needs of low-income and vulnerable populations, stakeholders can create sustainable solutions that empower individuals to protect their assets and livelihoods in the face of unforeseen challenges.

In conclusion, the expansion of the “Nan Shan Property Micro Fire Inconvenience Expense Insurance” to Tainan City represents a significant milestone in enhancing financial inclusion and risk protection for low and middle-income residents. Through strategic partnerships and proactive relief efforts, Nan Shan Property Insurance demonstrates its commitment to supporting communities and safeguarding individuals against the impact of fires. As this initiative continues to evolve, it is poised to make a lasting impact on the lives of vulnerable populations across Taiwan, fostering a more resilient and secure society for all.