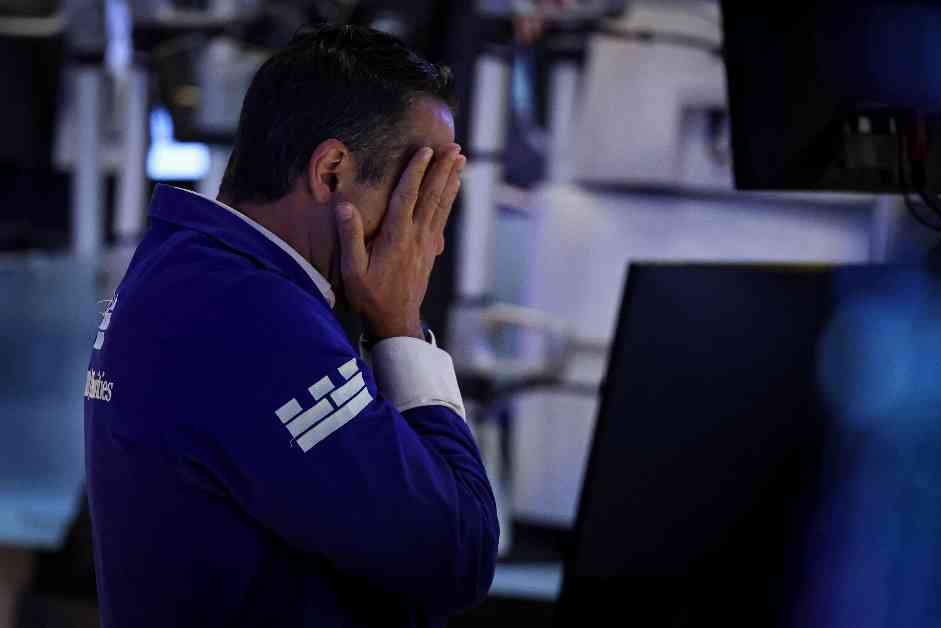

The latest US job report has had a significant impact on the S&P 500 and Nasdaq, leading to a continued decline in the stock market. Investors remain concerned about the softness in the labor market and are anxiously awaiting the release of the August employment data on Friday.

On Wednesday, the US stock market experienced slight declines amid volatile trading conditions. The persistent worries about the weakness in the labor market have caused Nvidia to continue its downward trend, dragging down both the S&P 500 and Nasdaq Composite indices. Both indices have seen a consecutive two-day decline, with investors closely monitoring the upcoming employment data release on Friday.

The S&P 500 index fell by 8.86 points, a decrease of 0.2%, closing at 5,520.07 points. The Nasdaq Composite index dropped by 52.00 points, a decrease of 0.3%, to settle at 17,084.30 points. Meanwhile, the Dow Jones Industrial Average rose by 38.04 points, an increase of 0.09%, to reach 40,974.97 points.

In the semiconductor sector, the Philadelphia Semiconductor Index rose by 0.3%, with AMD leading the gains. Taiwan Semiconductor ADR also saw a slight increase of 0.2%, while Nvidia continued its decline with a 1.7% drop, extending its losses to 11% over the past two days. Prior to the market close, Nvidia denied reports of receiving a subpoena from the US Department of Justice.

On the other hand, AMD saw a 2.9% increase after appointing former Nvidia executive Keith Strier as the Senior Vice President of Global Artificial Intelligence (AI). Defensive stocks performed relatively well in the market on Wednesday, as investors tend to gravitate towards these stocks during economic uncertainty. The utility sector of the S&P 500 index rose by approximately 0.8%, while consumer staples increased by 0.5%.

The yield on the US 10-year Treasury bond dropped to 3.768%, reaching its lowest level since July 2023. The yield on the 2-year Treasury bond fell below that of the 10-year bond for the second time since 2022. The Chicago Board Options Exchange Volatility Index remains above 21.

Data indicates that job vacancies in the US dropped to the lowest level since early 2021, with an increase in layoffs, reinforcing expectations for a significant rate cut by the Federal Reserve (Fed).

Atlanta Federal Reserve Bank President Bostic stated on Wednesday that the Fed should not maintain high interest rates for an extended period as it could potentially harm employment. He emphasized the risk of disrupting the labor market by lowering borrowing costs before inflation reaches the Fed’s 2% target, which could result in unnecessary pain.

Eric Freedman, Chief Investment Officer at US Bank Asset Management, expressed his expectation for volatility to persist until the end of the year, with an overall upward trend in performance. He stated, “September is always a volatile month in the stock market, but the economy is still expanding. Consumers and the labor market are doing well, so I remain bullish overall.”

Several large-cap growth stocks experienced declines, with Apple falling by 0.9%, Microsoft by 0.1%, Alphabet by 0.5%, and Amazon by 1.7%. On the other hand, Tesla saw a 4.2% increase.

Eric Beyrich, Co-Chief Investment Officer at Sound Income Strategies, noted that utility stocks rose on Wednesday due to the soft employment data, which supports the view that the Fed will cut rates by at least 25 basis points at its meeting in two weeks.

In company-specific news, Dollar Tree plummeted by 22% after reporting earnings significantly below expectations and revising its performance outlook. Conversely, Frontier Communications surged by 38% following reports that Verizon is in deep negotiations to acquire the Dallas-based fiber provider. Verizon saw a slight decline of 3.4%.

In conclusion, the US job report’s impact on the S&P 500 and Nasdaq has led to a continued decline in the stock market. Investors remain cautious about the softness in the labor market and are eagerly awaiting the release of the August employment data. The ongoing volatility in the market underscores the uncertainty surrounding economic conditions and the potential implications for future monetary policy decisions by the Federal Reserve.